GUIDE

Credit Card Decline Codes

Understand How They Impact Failed

Payment Recovery

Stop Losing Customers to Failed Payments

Every declined credit card transaction puts your customer relationship at risk, hurting your revenue and threatening your retention.

But here’s the thing: not all payment failures are the same and treating them that way means you’re leaving money on the table.

What you’ll learn from our guide:

- Not all decline codes are created equal

Payments fail for all kinds of reasons. Knowing the right approach for each decline type is key to keeping your customers — and keeping them happy.

- Why DIY recovery falls short

Retrying payments or sending reminders isn’t enough. In-house tools often can’t differentiate between various decline codes, leading to missed revenue.

- Ongoing recovery optimization is key

Banks frequently adjust their strategies, and Visa and Mastercard regularly update their rules. Your recovery strategy needs to continuously evolve to achieve top results.

Understanding decline codes can transform your recovery efforts and boost your retention. Don’t let failed payments cost you — download our guide!

AI-powered FinTech solution solving subscription

businesses' biggest cause of subscription churn

AI-POWERED

- AI platform powered by decades of payments industry expertise

- Trained on over 5B payment records, including risk factors

- Creates unique recovery strategies for each failed payment, adapting to the hundreds of reasons payments fail

- FlexPay clients recover up to 75% of failed payments

REVENUE CREATION

- Every recovered failed payment for subscription businesses saves a customer, not just single payments

- Subscription customers continue to bill successfully after failed payment recovery, increasing LTV and generating months of additional revenue payments

GROWTH ACCELERATION

- Invisible Recovery™ avoids customer exposure to failed payments and reduces the largest cause of indirect churn

- Each recovered customer generates additional months of subscription billings, creating cumulative growth acceleration

- FlexPay clients earn up to 33% additional annual revenue from FlexPay’s customer recovery performance

The Mission Critical Technology for Subscription Businesses

Top 3 insights you need to know about failed payments

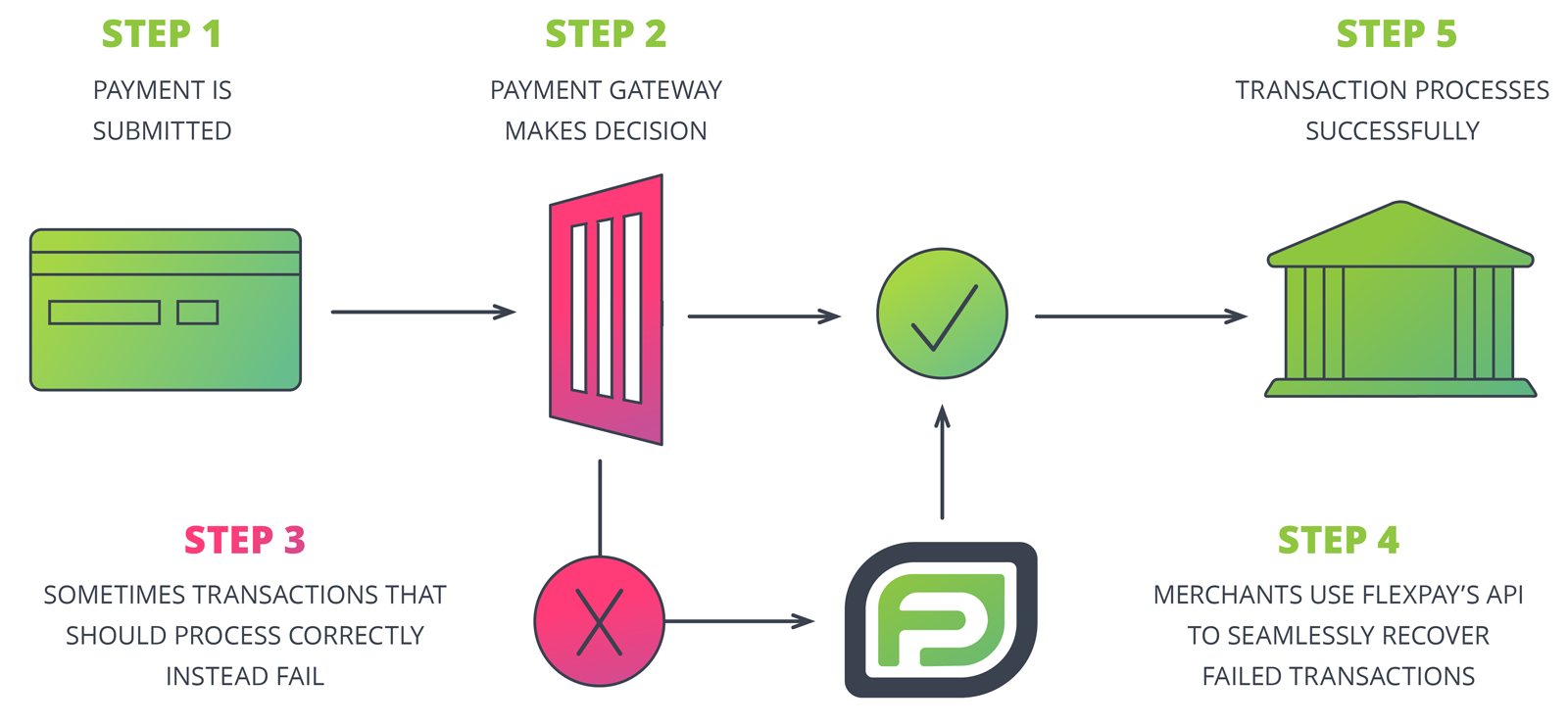

How it works

Merchants use FlexPay’s API to re-capture up to 75% of failed transactions

FlexPay is the leading Payment Authorization Management solution, helping subscription businesses accelerate revenue and profit growth by recovering failed payments, which is the single largest cause of customer churn.

© 2024 FLEXPAY PRIVACY POLICY